- 28 Feb, 2025

- Technology

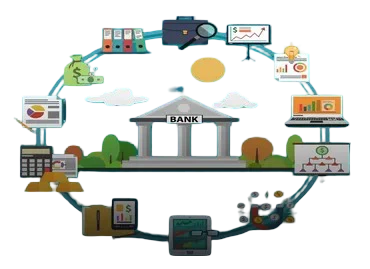

How Generative AI is Revolutionizing the Banking Sector

Generative AI is transforming the banking sector by enhancing efficiency, improving customer experiences, and optimizing financial operations. Banks are leveraging AI-driven solutions to automate processes, detect fraud, and provide personalized financial services.

AI-Powered Customer Support

Generative AI enables banks to offer 24/7 customer support through intelligent chatbots and virtual assistants. These AI-driven tools can handle inquiries, assist with transactions, and provide financial advice, reducing wait times and improving customer satisfaction.

Fraud Detection and Prevention

Traditional credit scoring methods rely on limited financial data. Generative AI analyzes broader datasets, including spending habits and transaction history, to assess creditworthiness more accurately. This enables banks to make informed lending decisions.

AI in Credit Scoring and Loan Approval

AI assists banks in adhering to regulatory requirements by monitoring transactions and ensuring compliance with financial laws. AI-driven compliance tools help institutions avoid penalties and maintain transparency in operations.

The Future of AI in Banking

Generative AI is revolutionizing the banking sector by making financial services more efficient, secure, and customer-centric. As AI continues to evolve, banks will further integrate AI-driven solutions to enhance operations and provide seamless banking experiences.

02 Comments

Priya Patel

March 01, 2025 at 2:37 pmGenerative AI is transforming the way banks operate! The ability to automate processes and detect fraud in real time is incredible. Looking forward to seeing how AI enhances personalized banking even further.

Amit Sharma

March 12, 2025 at 2:37 pmAI-driven banking solutions are making financial services more seamless and efficient. The future of banking is digital, and AI is at the heart of this transformation! Exciting times ahead for the industry.